- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

Globally, addressing climate change and promoting a low-carbon economy have become undeniable trends. Among these, the EUs Carbon Border Adjustment Mechanism (CBAM) is a significant initiative aimed at ensuring that the EUs internal emission reduction efforts are not undermined by carbon leakage. So, as an exporting enterprise, how can you determine whether your products fall under CBAMs scope of control, and how should you respond to this new trade environment?

I. CBAM Regulatory Scope and Judgment Criteria

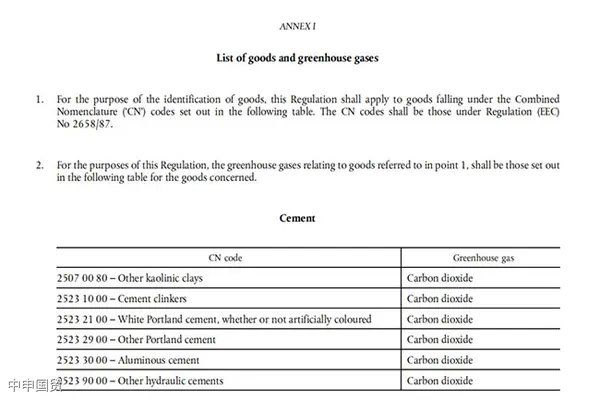

The implementation of CBAM is primarily based on the REGULATION (EU) 2023/956 legislation, which provides a specific list of controlled products in Annexes I and II (starting from page 39 of the regulation document PDF). Enterprises must first verify whether their products CN code is listed in the annex tables. If the exported products CN code is listed, it means the product is subject to CBAM control and must comply with the relevant regulations and procedures.

Regulatory Document:REGULATION (EU) 2023/956

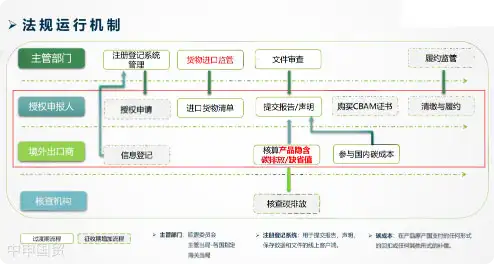

II. CBAM Requirements for Enterprises

During the CBAM transition period, exporting enterprises must calculate the embedded carbon emissions of their products in accordance with official guidelines and implementation rules, and convey this information to downstream customers. This process involves quantifying direct emissions from the production process, including indirect emissions from electricity and other energy usage, as well as the embedded carbon emissions of raw and auxiliary materials.

III. Calculation and Tracing of Product Embedded Carbon Emissions

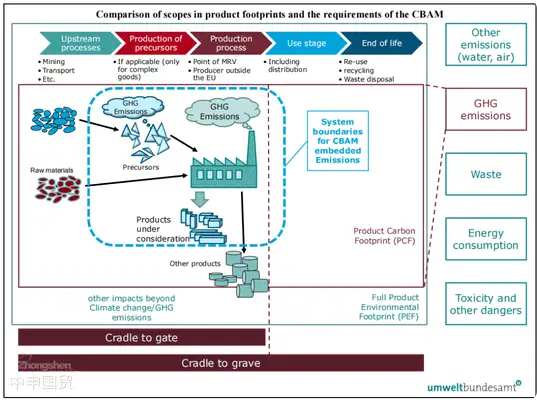

Product embedded carbon emissions are similar to the concept of product carbon footprint but cover a smaller scope. The calculation of embedded carbon emissions includes direct emissions (such as CO2 from calcium carbonate decomposition) and indirect emissions (such as CO2 from electricity usage), as well as the embedded carbon emissions of raw and auxiliary materials. For raw and auxiliary materials within CBAMs regulatory scope, enterprises must trace their embedded carbon emissions. In the absence of upstream supplier data, enterprises may temporarily use default values provided by CBAM. However, starting from July 2024, emissions calculated using default values must not exceed 20% of the total embedded carbon emissions.

IV. Future Scope of CBAM Controls

As a supplement to the EU carbon market mechanism, CBAMs future regulatory scope will align with industries covered by the EU carbon market. It is expected to include organic chemicals with CN codes starting with 29 as early as 2026, with plans to cover all industries or activities under the EU carbon market by 2030.

Related Recommendations

Learn

Get in Touch

Email: service@sh-zhongshen.com

Related Recommendations

Contact via WeChat

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912